Adulting 101: A Beginner’s Guide to Building Credit When Financial Stress Has Flattened Your Emotions

For many women, emotional flatness does not come from a lack of desire, ambition, or creativity.

It comes from carrying too much responsibility for too long.

Financial stress is one of the most common, and least talked about, contributors to emotional numbness. When money feels uncertain, unsafe, or overwhelming, the nervous system adapts by narrowing focus. You stop dreaming. You stop planning long-term. You do what needs to be done and push everything else aside.

Building credit may seem like a purely practical task, but for women under financial strain, it is often emotionally loaded. Fear of making mistakes. Shame about not knowing more. Avoidance because the system feels punishing instead of supportive.

This guide is designed to meet you there. Not with pressure. Not with hustle. But with clarity, stability, and small steps that restore a sense of control.

How Financial Stress Leads to Emotional Flatness

When money feels tight or unpredictable, your body treats it as a threat.

Over time, this can create:

Chronic tension or anxiety

Emotional numbness or detachment

Difficulty feeling motivated or excited

Avoidance of financial tasks altogether

This is not a personal failure. It is a biological response.

Your nervous system prioritizes survival over expansion. Credit, debt, and financial planning can start to feel overwhelming, even when you intellectually know they matter.

The goal here is not to “fix” your emotions. It is to reduce the stressors that keep your system stuck in defense mode. Understanding and building credit is one of those stabilizing moves.

What Credit Really Is (And What It Is Not)

At its core, credit is a record of trust system.

When a lender looks at your credit profile, they are asking one question: How likely is this person to pay back borrowed money on time?

Credit is not:

A judgment of your character

Proof that you are behind in life

A reflection of your intelligence or worth

Credit is simply data about how borrowing has been handled over time and a tool that affects what opportunities are available to you.

Your credit history influences:

Whether you can rent an apartment

Interest rates on car loans and mortgages

Insurance premiums in some states

Utility deposits

Job background checks in certain industries

When credit is unclear or damaged, it can quietly increase stress by limiting options. Higher deposits. Higher interest rates. Fewer choices. More friction.

When credit becomes stable, it reduces background noise. It creates breathing room. It allows your nervous system to relax just enough to feel again.

Understanding this early gives you leverage instead of fear.

How Credit Scores Work (In Plain Language)

Your credit score is a numerical summary of how you have handled credit so far. Most scores fall between 300 and 850.

While there are multiple scoring models, they all weigh similar factors.

The Five Core Components of a Credit Score

1. Payment history (about 35%)

This is the most important factor. Paying bills on time matters more than anything else.

Late payments, collections, and charge-offs hurt your score significantly, especially recent ones.

2. Credit utilization (about 30%)

This refers to how much of your available credit you are using.

Example:

If you have a $1,000 credit limit and carry a $700 balance, your utilization is 70%.

Lower utilization generally means higher scores.

3. Length of credit history (about 15%)

This looks at how long your accounts have been open. Older accounts help because they show consistency over time.

4. Credit mix (about 10%)

Having different types of credit (credit cards, student loans, auto loans) can help, but it is not required to build good credit.

5. New credit inquiries (about 10%)

Applying for multiple accounts in a short period can temporarily lower your score.

Why Building Credit Early Matters

Building credit early does not mean going into debt early. It means creating a positive track record while the stakes are still low.

Good credit can:

Save you tens of thousands of dollars in interest over your lifetime

Reduce stress during major life transitions

Give you negotiating power

Allow you to say yes to opportunities without scrambling

The goal is not perfection. The goal is momentum.

Why Credit Building Can Feel Emotionally Heavy for Women

Many women dealing with emotional flatness are also:

Carrying the mental load for a household

Recovering from divorce or relationship instability

Supporting children or extended family

Managing inconsistent income

Trying to be “responsible” without clear guidance

Credit systems were not designed with emotional safety in mind.

If you have avoided credit tasks, ignored statements, or delayed learning how it works, that does not mean you are bad with money. It means your system was overwhelmed and chose preservation.

This guide focuses on rebuilding without shame.

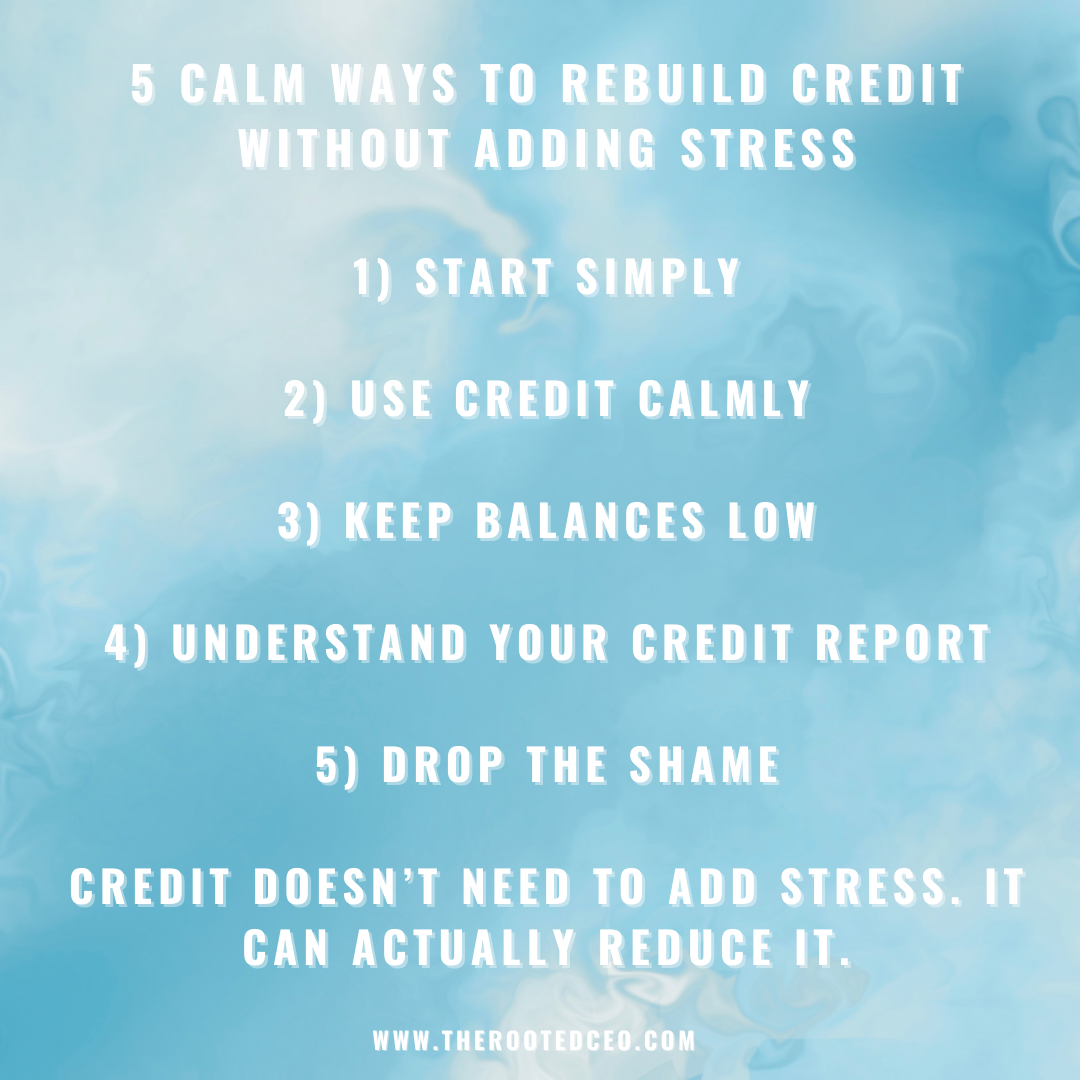

Step One: Choose the Least Stressful Way to Start

If your nervous system is already taxed, simplicity matters. The best beginner credit options are the ones that reduce risk and decision fatigue.

Best Options for Beginners

Secured credit card

You put down a cash deposit (usually $200 to $500), which becomes your credit limit. These are ideal if you have no credit or poor credit. There is no surprise debt. This can feel safer when trust is low.

Student credit card

Designed for people with limited history. These often have lower limits and fewer perks, which is actually a good thing early on. Lower limits mean fewer opportunities for mistakes.

Authorized user status

Being added to a trusted person’s credit card can help you inherit their positive history, as long as they pay on time and keep balances low.

Avoid store cards and “guaranteed approval” offers with high fees. They often cost more than they are worth. The goal is not speed. It is safety and consistency.

Step Two: Use Credit to Build Stability, Not Pressure

You do not need to use credit aggressively to build it well. The fastest way to build strong credit is to be uninteresting.

Here is what a regulated use looks like:

Charge one or two small recurring expenses

Low balances that are easy to pay off. Keep balances below 30% of your limit, ideally under 10%

Pay the statement balance in full every month whenever possible

Set up automatic payments to remove mental load

Credit rewards consistency and calm boring behavior. That is a feature, not a flaw.

Step Three: Credit Utilization Without the Anxiety Spiral

Utilization is one of the most misunderstood concepts in credit building. One of the most stressful aspects of credit is not knowing how much is “too much.”

You do not need to carry a balance to build credit. Carrying a balance just means paying interest.

What matters is:

How much of your limit is used when the statement closes

Whether you pay on time

A simple guideline:

Try to keep balances under 30% of your limit

Lower is better, but perfection is not required

A good rule of thumb:

If your limit is $1,000, keep the statement balance under $300.

Under $100 is even better

This is not about restriction. It is about signaling steadiness, both to lenders and to yourself.

Step Four: Understanding Your Credit Report as Information, Not a Verdict

Your credit score is a snapshot. Your credit report is the story. Your credit report is not a moral scorecard.

It is a list of accounts, dates, and payment histories. Reviewing it can feel intimidating, especially if you are afraid of what you will find.

But avoidance keeps stress active. Information reduces it.

You have three main credit reports maintained by:

Experian

Equifax

TransUnion

You are entitled to free reports from all three every year. Reviewing them helps you:

Catch errors that may not be your fault

Spot identity theft early

Understand what lenders actually see and what is actually impacting your score

Many people assume bad credit means failure, when in reality it is often incorrect data. You are allowed to look at your financial picture without self-judgment.

Step Five: Common Credit Mistakes That Come From Stress, Not Carelessness

These mistakes are incredibly common and completely avoidable. Many credit mistakes are coping strategies, not irresponsibility.

These include:

Missing payments because of overwhelm

Maxing out cards during emergencies

Avoiding statements to reduce anxiety

Closing accounts to simplify, without realizing the impact

Awareness changes patterns. Shame reinforces them. If mistakes exist, they are data points, not life sentences.

How Long It Takes to Feel Financial and Emotional Relief

This depends on consistency, not income. Credit improvement happens gradually, and so does emotional thawing.

General timeline:

3 to 6 months: First score appears. A few months of consistency brings clarity

6 to 12 months: Noticeable improvement with on-time payments

12 to 24 months: Strong foundation if habits stay consistent

3+ years: Excellent credit is possible. Emotional energy often returns once the background stress lowers

Credit building is not a sprint. It is closer to strength training. Slow progress compounds. You are not broken if you do not feel immediate relief. Regulation takes time.

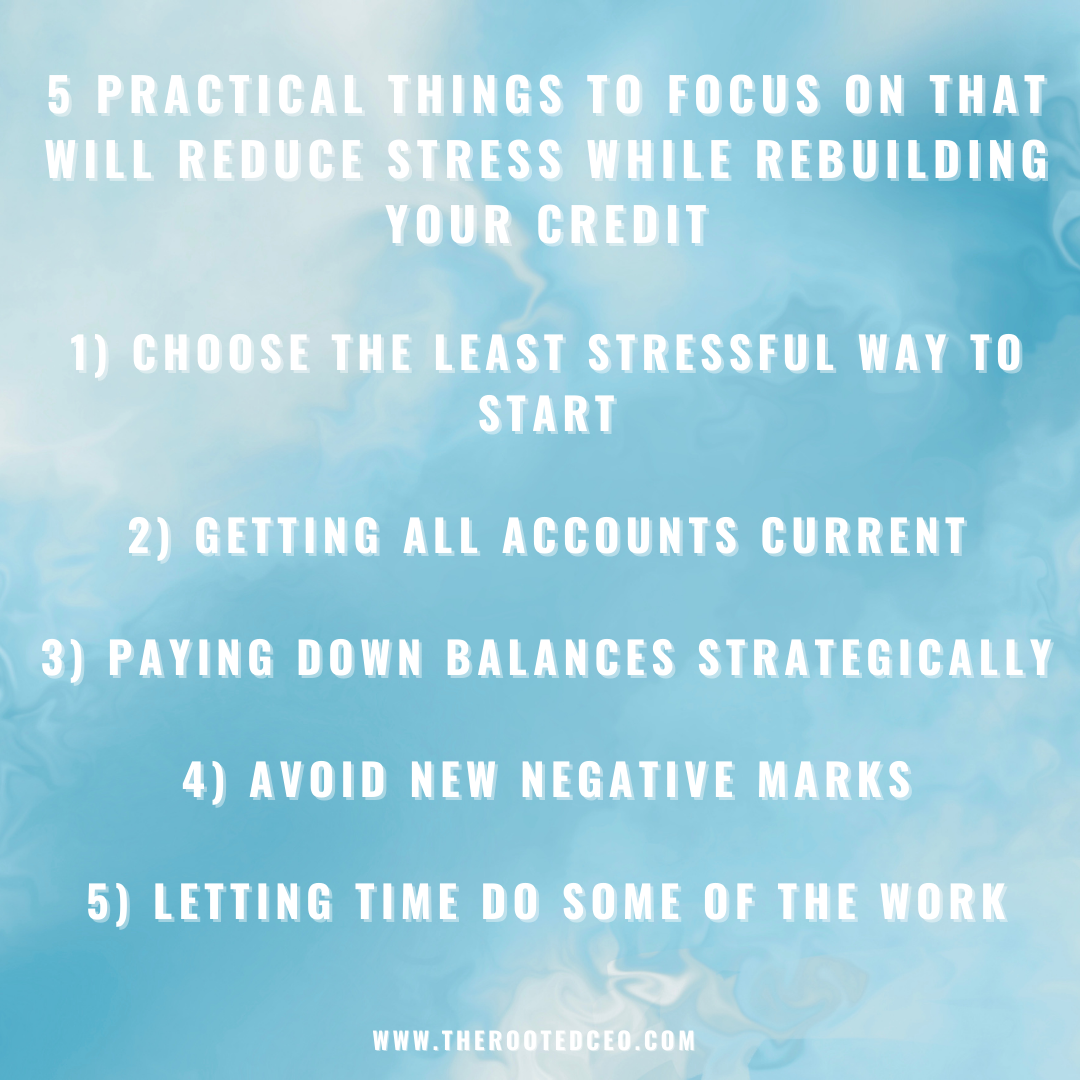

Rebuilding Credit While Rebuilding Yourself

If you already have late payments, collections, or high balances, you are not doomed. For women experiencing emotional flatness, financial stability is often a missing piece, not the whole puzzle.

But it matters.

Each on-time payment is a small signal of safety. Each reduced balance lowers cognitive load. Each clear statement builds trust with yourself.

Focus on:

Getting all accounts current

Paying down balances strategically

Avoiding new negative marks

Letting time do some of the work

Credit scores are forward-looking. Recent behavior matters more than old mistakes. Credit building is not about becoming a different person. It is about creating conditions where your nervous system no longer has to stay guarded.

Credit Is a Tool, Not a Personality Trait

One of the most important things to understand about credit is that it is separate from your identity.

Bad credit does not mean you are irresponsible. Good credit does not mean you are financially enlightened.

Credit simply reflects behavior within a system that was never properly explained to most people. Once you understand the rules, you can play the game calmly and intentionally.

Final Thoughts: Stability Precedes Desire

Emotional flatness is not something to push through. It is often something that softens when life feels less precarious.

Building credit in a calm, informed way is one of the most practical forms of self-support available. Not flashy. Not romantic. But deeply regulating.

Adulting is not about having everything figured out. It is about learning how to create steadiness, one small system at a time.

And that is enough to begin feeling again.

If budgeting has felt restrictive or stressful, the full Adulting 101 guide on sticking to a budget without feeling restricted is linked here.